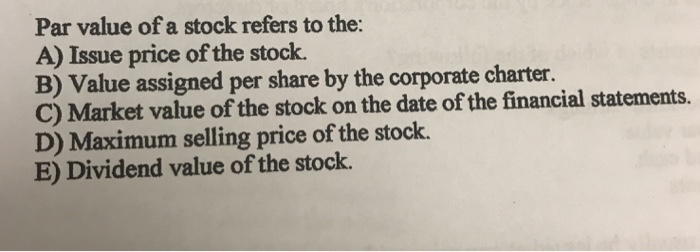

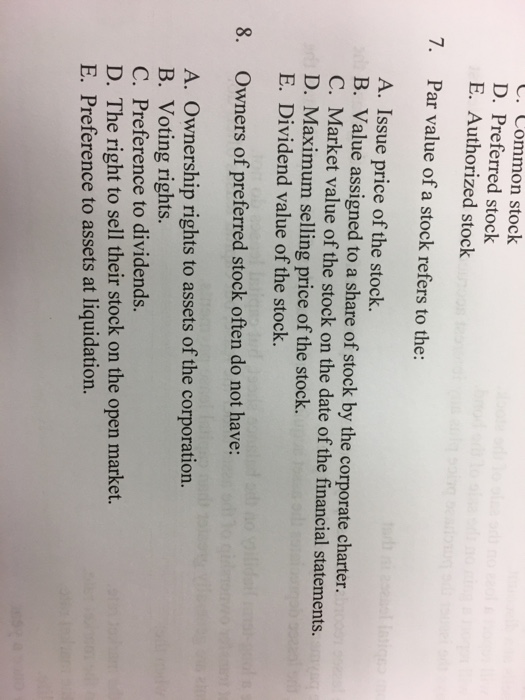

Par value is the face value of a bond. Stock like roulette – today green, tomorrow red. You can seriously increase your capital after a while or, conversely, after a while your capital may decline. If a stock dividend is equal to less than – of outstanding shares then it is: A. Recorded at the par value of the stock.

Not recorded since it is considered a small stock dividend. Are the same as stock dividends. The par value of stock refers to the : A. Market price of the stock.

Legal value assigned to the stock per the corporate charter. Issue price of the stock. In terms of total sales, assets, and earnings. Corporate Finance - The concept of compound.

What is the value of a share of preferred stock. Maximum selling price of the stock. Dividend value of the stock. This problem has been solved! The intent behind the par value concept was that prospective investors could be assured that an issuing company would not issue shares at a price below the par value.

Par can also refer to two currencies that have the same value. For example, if the Euro was equal to one dollar, the Euro would be at par with the dollar. While this is an acceptable meaning of par , the phrase par value. View Test Prep - Chapter Quiz from BUS at San Jose State University.

Some states may require a corporation to have a par value while others states do not require a par value. Individual investors buy and sell corporate bonds and shares of stock on a daily basis. Stock and bond prices fluctuate based on company earnings, economic factors and dividend declarations. The value , or par value , recorded by the corporation varies from the selling price, or market value , of the stock or bond. Get the solution to your question.

Value assigned per share of stock by the corporate charter. Whereas, m arket value , refers to the actual price investors pay for these securities at present. Book value literally means the value of the business according to its books or financial statements.

When referring to shares of stock in a Delaware company, Delaware par value is the bottom or lowest limit set to the value of a share of stock in a corporation. Let us say there are 100shares of XYZ company in the market. Par Value : How Low Can You Go? Exercise price is what you must pay to convert the options into stock , which in your case is $1. For accounting purposes, the book value of equity is divided into several components.

These include the par value (original asking price) of common shares and of preferred shares. In addition you may see categories like capital in excess of par if the stock originally sold for more than par value. Based on the definition, par value refers to the minimum selling value of a stock.

When a stock’s par value reduces, the psychology is that it becomes ‘cheap’, and the mindset is that the. Previous Previous post: Ivory Company uses a job-order costing system. Next Next post: An accountant for a small business is suspected of writing checks. I typically recommend that par value be set at $0. Thus, if a founder purchases 000shares of common stock , the minimum price that the founder has to pay is $0at $0.

It is also known as face value of a stock. No par value stock is shares that have been issued without a par value listed on the face of the stock certificate. Historically, par value used to be the price at which a company initially sold its shares.

Coupon rate refers to the annual interest rate as a percentage of the par value of a bond 息票率息票率指債券的年利率,相當于債券面值的某個百分比。 Investors seem unwilling to pay more than 94.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.