If you need your prior year Adjusted Gross Income (AGI) to e-file, choose the tax return transcript type when making your request. If you only need to find out how much you owe or verify payments you made within the last months, you can view your tax account. An IRS transcript is a summary or overview of your tax return information. Prior year tax returns are available from IRS for a fee.

For those that need tax transcripts, however, IRS can help. A transcript summarizes return information and includes Adjusted Gross Income (AGI). They are available for the most current tax year after the IRS has processed the return.

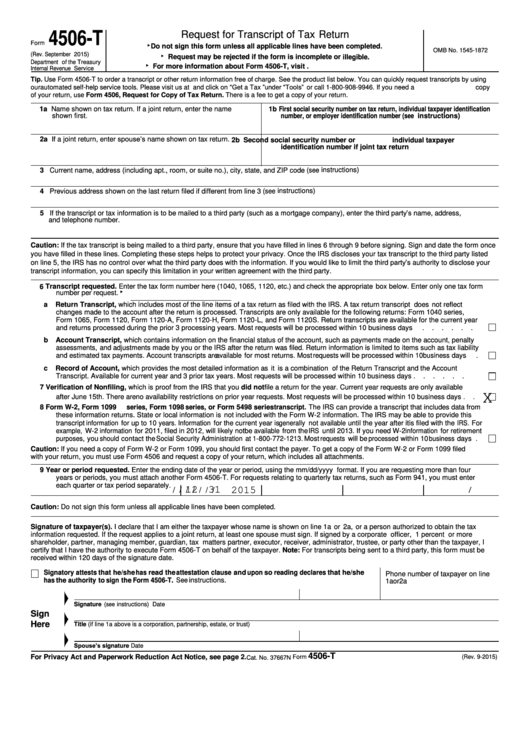

How to Get an IRS Transcript. Requesting a tax transcript is a simple and free process. The IRS even has an online portal, which you can use to request either a PDF on your computer or a paper copy in the mail.

You can also call the IRS to. For requests made via mail, allow days for the delivery of your transcript. The IRS developed a new transcript format to better protect tax information from identity theft. In this new format, the IRS. The IRS will mail the transcript to the address of record entered on the.

Current name of the first tax filer and address, city, state and zip code. This is the address where the IRS will send the transcript. Previous address shown on the last tax return if different from line 3. A Check this box to request the tax return transcript. Current year information may not be completely available until July.

GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY! Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities. A tax filer may also obtain a tax return transcript by electronically submitting a transcript request using the IRS Get Transcript by Mail option at the. These request methods will result in the IRS mailing a paper transcript to the address. Fill Out The Request For Transcript Of Tax Return Online And Print It Out For Free.

Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms. Under Tools, click Get Transcript of your Tax Records. Click Get Transcript by MAIL. If you are a First Time User, click “Create Account”.

Be sure to follow the instructions on page of the printout. Select Option to request an IRS Return Transcript and then enter the year of the return. In addition to these methods, the IRS offers an online ordering tool to request tax return and account transcripts. The IRS separates transcripts by perio and you must request a transcript for each year you want information for. Tax filers can request a transcript, free of charge, of their tax return from the IRS in one of three ways.

The fastest way to submit official IRS tax data is to use the IRS Data Retrieval Tool (DRT) on the FAFSA. IRS Tax Return Transcript Request Process. A tax return transcript will show most line items contained on the return as it was originally filed.

If you need a statement of your tax account which shows changes that you or the IRS made after the original return was file however, you must request a tax account transcript.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.