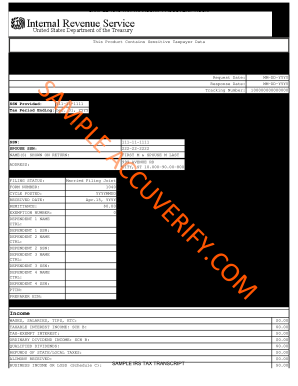

It will show most line items on the original tax return filed. Get your tax transcript online or by mail. Find line by line tax information, including prior-year adjusted gross income (AGI) and IRA contributions, tax account transactions or get a non-filing letter. Several transcript types available. Larson This Product Contains Sensitive Taxpayer Data.

The following items reflect the amount as shown on the return (PR), and the amount as adjusted (PC), if applicable. They do not show subsequent activity on the account. IRS transcripts enable taxpayers to obtain a record of their tax filings or subsequent adjustments to their return. Many lending companies and universities require tax transcripts as a way to verify income.

Obtaining a copy of your IRS transcript is relatively easy, but understanding the codes listed on the transcript can prove more difficult. This video will show you how a IRS tax Transcript looks like. Tax Returns Versus Tax Transcripts. Current year information may not be completely available until July. However, we do sometimes ask for other IRS documents.

FAFSA instructions direct applicants to obtain information from certain lines on IRS income tax returns and schedules. For the most part, the instructions identify the relevant lines on the tax by line number. A sample of the new transcript format is included below. Our numbers are going in the right direction,” said Acting IRS Commissioner David Kautter.

If you need tax return information, you can get a tax return transcript from the IRS at no charge. Simply provide the IRS with basic identification information, such as your name and Social Security. It does not reflect any changes you, your representative, or the IRS made after the return was filed. What Is a Tax Transcript ? The IRS makes it easy to get your hands on a tax transcript , as you can request one online or by mail. How to get a tax transcript.

You will, however, need to provide. Request may be rejected if the form is incomplete or illegible. Updated weekly (Probably over the weekend). GOVERNMENT SYSTEM IS FOR AUTHORIZED USE ONLY!

Use of this system constitutes consent to monitoring, interception, recording, reading, copying or capturing by authorized personnel of all activities. Sample Of Tax Account Transcript. The IRS is now published a fact sheet and FAQs to help you better understand the new IRS tax transcripts.

Here is a sample: New Tax Transcript (PDF) Because the taxpayer’s SSN no longer can be used as a tracking number for third-party requesters, the IRS is creating a Customer File Number that third parties may use as an identifying number. If you need a statement of your tax account which shows changes that you or the IRS made after the original. Enter only one tax includes mo the. A tax return transcript does not reflect t after th r urn i ssed. The new tax transcript will be available to the taxpayer or tax professionals beginning on September 23.

The IRS is making these changes because the tax transcript has become a sought after document by identity thieves. The IRS says you should keep a copy of your tax return for at least three years. If you don’t have a copy, you can order one from the IRS.

Why you might need a copy of your tax return Your old tax. Requesting a tax transcript is a simple and free process. The IRS even has an online portal, which you can use to request either a PDF on your computer or a paper copy in the mail.

You are only required to submit the first page of your tax return transcript. You can also call the IRS to. The highlighted sections are sections that you cannot blackout.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.