Get your tax transcript online or by mail. Find line by line tax information, including prior-year adjusted gross income (AGI) and IRA contributions, tax account transactions or get a non-filing letter. Several transcript types available.

It also shows changes made after you filed your original return. If you need to see your past tax information, an IRS transcript can help. Here are the different types of IRS transcripts and how you can get one. Request a transcript online.

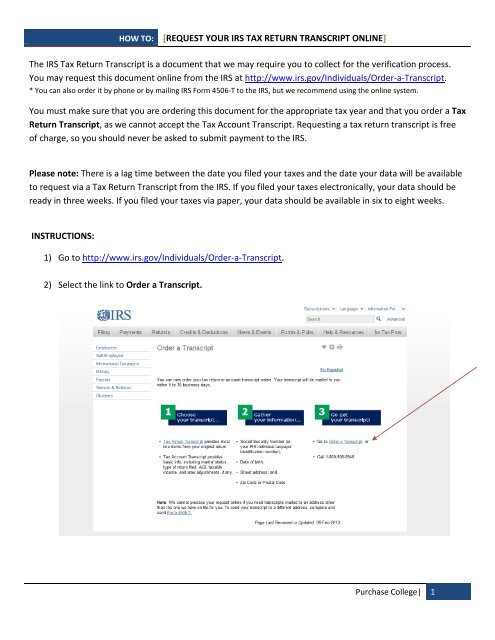

This is the easiest option for many people. From there, you should be able to view the transcript you nee and then print or download it. To get an IRS transcript , start by creating an account at IRS. Like the basic tax transcript , the tax account transcript also shows things such as your marital status, type of return file adjusted gross income and taxable income. The most complete info request is for exact copies of your previous filings.

You can have a transcript sent directly to your lender, who should get it in about days after you. You do not need a tax return copy if you only need the previous year AGI. When applying for a mortgage, loan, etc.

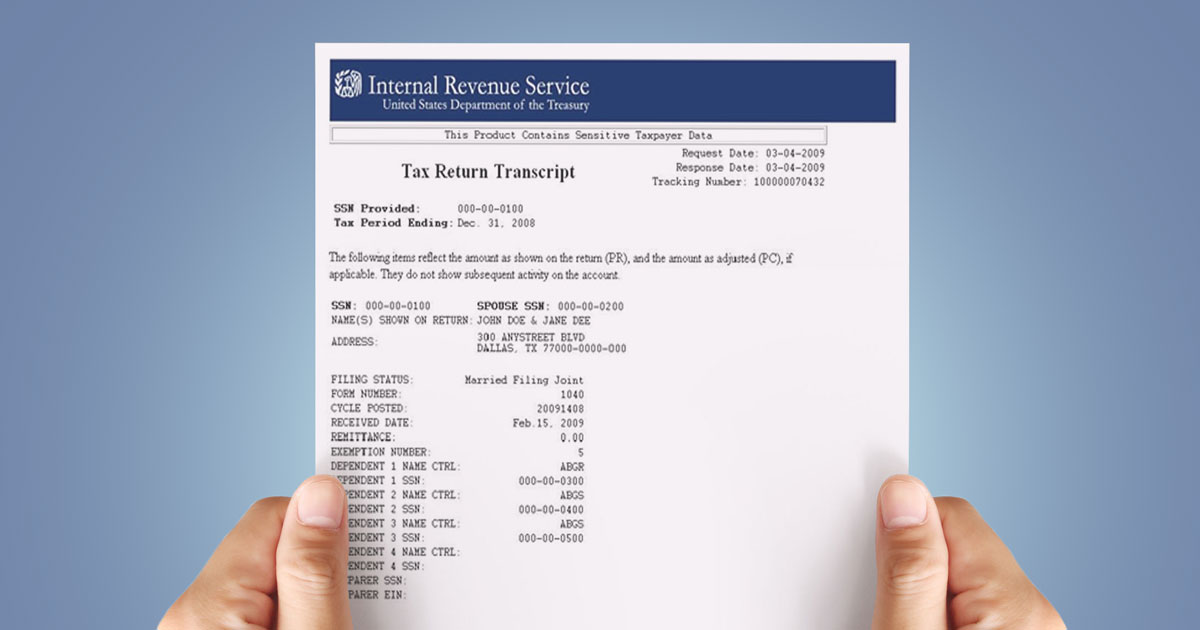

While a transcript is a document that summaries the information from your tax return, a copy shows your. IRS Data Retrieval Tool for FAFSA. Your IRS tax transcripts are only available for the current year and for three years prior online or by mail.

When you mail in this form, your tax. Choose from five types of IRS tax transcripts, depending on which is applicable to you. The IRS makes it easy to get your hands on a tax transcript , as you can request one online or by mail. You will, however, need to provide some key information, like. With improvements in the Internet and updates to the IRS website, you can file your federal and state taxes online safely and quickly.

Most taxpayers can now file all of their forms required for tax season online – directly through the Internal Revenue Service or through a private online tax company. Transcripts are not exact duplicates as photocopies are. Tax transcripts are used to validate income and tax filing status to complete Financial Aid Verification. Auto-suggest helps you quickly narrow down your search by suggesting possible matches as you type.

How to obtain a tax transcript from turbotax? The IRS previously announced the improvements to the transcript design, which is aimed at making the product more secure. By planning ahea they should.

You can dovmload and print your transcript immediately, or request the transcript be mailed to your address on record. You may file electronically through a 3rd party software vendor or file by paper. A Copy Of Your Past Federal Tax Returns You may need to get a record of your past federal tax returns, also called IRS transcripts.

IRS transcripts are often used to validate changes to your taxable income if you are disputing your state tax obligation. Department of Revenue conducted an audit of your return and changed items from the original return the IRS chose not to. It includes your adjusted gross income (AGI), the totality of your income in various taxable forms, and when, how, and how much you’ve made in the way of payments. While the item may be priced similarly at different shops. A tax return transcript shows you line-by-line what items are on the original tax return, including any tax forms or schedules that accompanied it.

You can get a copy from the Internal Revenue Service, or IRS, for no charge. However, it does not show any changes you made after filing the original return. You can only obtain a tax return transcript going back four years, including the current tax year.

Please include your name, address, Social Security number, the tax year you are requesting and your signature.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.