When a credit card is used in a disputed purchase, the six parties to a dispute are: The consumer: You bought it, but you don’t like it. The consumer’s card issuer: This is the financial institution that issued the credit card to the consumer. You also need to account for changes based on card scheme, reason code, and countless other variables. It’s a lot to keep up with…so much, in fact, that most merchants end up lagging behind. Has your credit card company ever charged you twice for the same item or failed to credit a payment to your account?

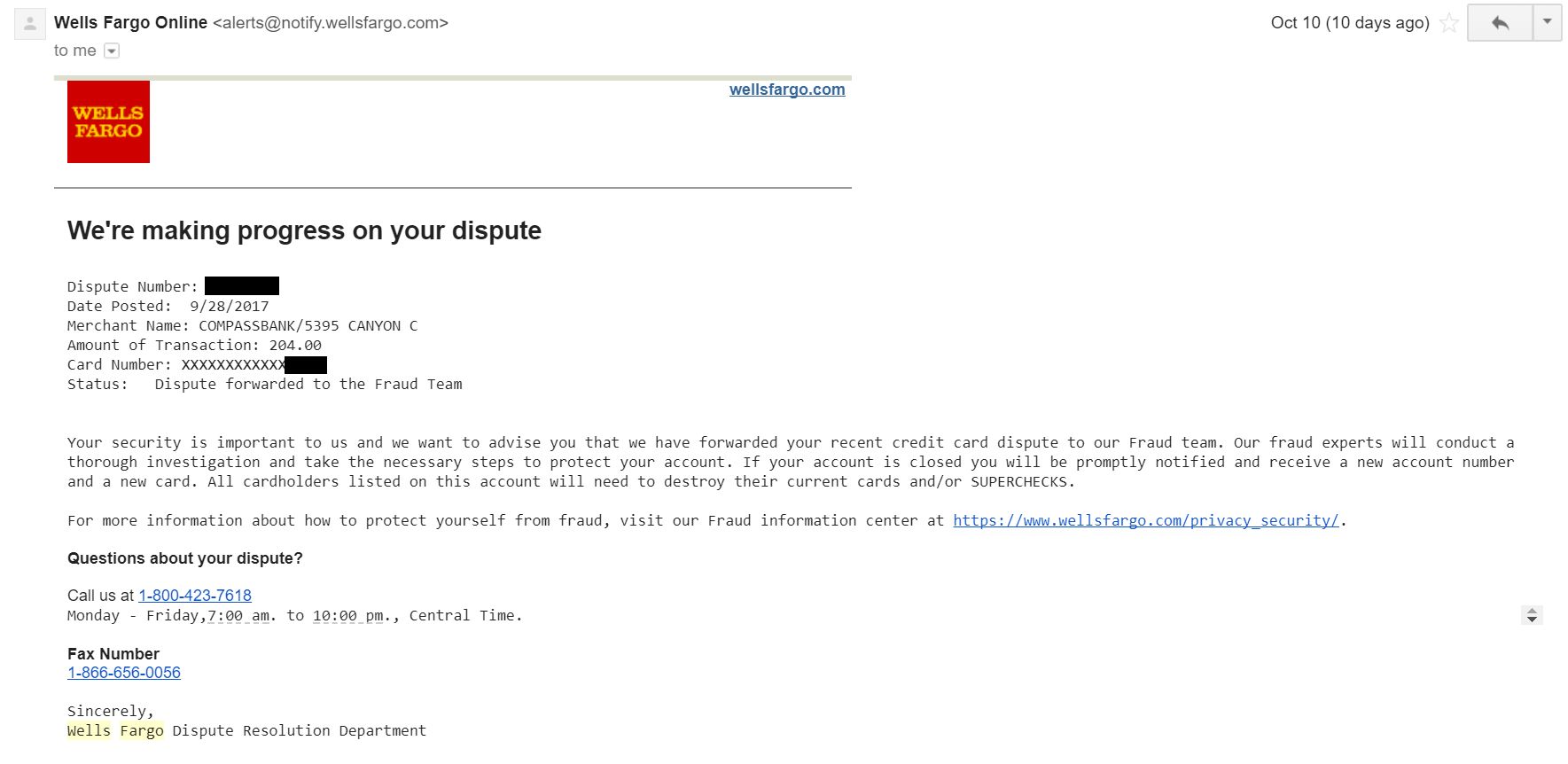

While frustrating, these errors can be corrected. It takes a little patience and knowledge of the dispute settlement procedures provided by the Fair Credit Billing Act (FCBA). Steps in the Commercial Card Dispute Process. The cardholder (or the company program administrator) contacts the merchant involved. The card -issuing bank may require you to complete a dispute resolution form.

Thereafter, the card -issuing bank would perform a chargeback of the disputed transaction(s) to the merchant. In most instances, the banks will provide you with a temporary credit or refund the disputed transactions so that your spending balance is not affected. NORDSTROM CREDIT CARD DISPUTE RESOLUTION FORM Please return this form and any supporting documents via fax to 866. Nordstrom Card Services, Attn: Dispute Dept. If you’re disputing unauthorized or fraudulent charges, please contact our customer service department at 800.

You can dispute incorrect charges on your credit card statement. We can help you determine if a charge is valid and guide you through how to dispute it. CIBC may also be able to dispute a. Consumer abuse of the chargeback process also will be curtailed by the new dispute resolution system. The number of chargebacks allowed from a given account will be restricted to within a 120-day perio according to 3Payment Solutions, a provider of card -processing technology. Considering that Visa is the No.

You should continue to make at least the minimum payment on your credit card balance. For your convenience, the card number can be obtained from your credit card Statement of Account or from. We’re here to help you investigate and fix any possible report inaccuracies. Disputing is free and easy to do yourself. In a perfect worl you would never have to dispute a credit card charge.

With that in min the best thing you can do to protect yourself against billing errors is to check your credit card accounts regularly. How do I check the status of a billing dispute ? Credit card fraud happens when someone makes an unauthorized charge with your account, which may happen when a card is out of your possession, lost or stolen. Our dispute resolution team will challenge this dispute by submitting evidence on your behalf.

The credit card processor has deducted this amount and a chargeback fee of $from your account balance. Phase Two of the Mastercard Dispute Resolution Initiative concerns unjust enrichment. This describes a situation in which the issuer performs a chargeback, while a merchant also issues a credit to the cardholder. This problem is currently resolved by compliance or pre-compliance case.

No credit card required! Place a security freeze Place or manage a freeze to restrict access to your Equifax credit report, with certain exceptions. Dispute information on your Equifax credit report Submit a dispute if you notice something is inaccurate or incomplete on your credit report. Card issuers will likely see an increase in the number of cardholder disputes as the percentage of consumer transactions paid with debit and credit cards continues to increase.

A card issuer’s obligations for merchant disputes depend on whether a credit or debit card was used and certain other factors. Before you file a dispute with your creditor, it is strongly encouraged to try to resolve the issue with the merchant first. Most reputable merchants will try to work with you. If they are unresponsive or refuse to work with you, then file a credit card dispute with your credit card issuer.

The dispute process typically involves the credit card agency investigating the charges in conversation with the merchant. If the credit card dispute is resolved in.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.