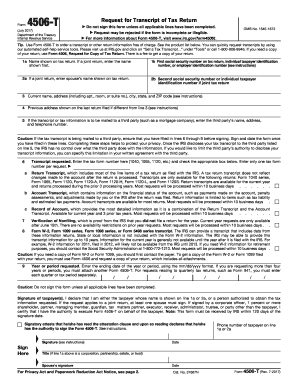

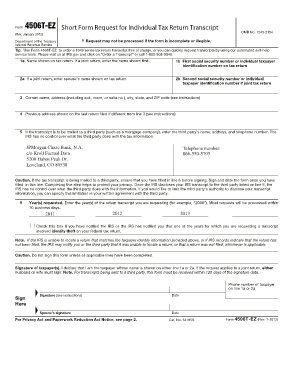

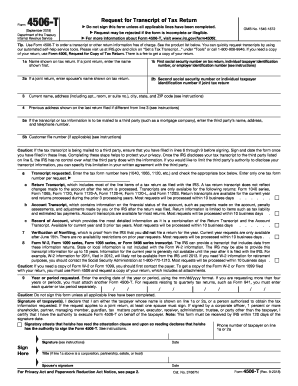

Note: If you are unsure of which type of transcript you nee request the Record of Account, as it provides the most detailed. You may be asked to sign, date, and return this form, which gives us permission to verify the income you reported to the IRS in prior years. Your information on this form – such as your. The purpose of this document is to receive a tax return transcript, tax return, or other tax records. In addition to using this form, you must also include information about yourself so that your identity can be verified.

The document gives permission for a third party to retrieve the tax payers data. IRS for 1-years prior to the request. Information, such as name and address, must exactly match the same information on your tax form. T forms from the Internal Revenue Service. See the product list below.

There is a fee to get a copy of your return. To Learn how to fill Various. Trying to find unique concepts is among the most exciting actions but it can as well be annoyed whenever we could not find the desired idea. Thank you for stopping by at this. Our web‐based fulfillment returns IRS tax transcripts requests - direct and complete.

Over of all mortgage fraud includes income or identity misrepresentations. Click here to login or now. The most secure digital platform to get legally binding, electronically signed documents in just a few seconds.

Available for PC, iOS and Android. Start a free trial now to save yourself time and money! After filling the form and faxing it to the right number, Will they fax my transcript to me?

Can anyone explain better to me. Typically once they receive your request for a transcript they will mail the requested transcript to the address on file with the IRS. Used to Request your Information Returns. The IRS calls Information Returns Wage and Income Transcript.

Fill out, sign and edit electronic documents in a few minutes. Use your computer or mobile to download and send them instantly. Forget about software installing and apply the best online tools. Request for Transcript of Tax Return Do not sign this form unless all applicable lines have been completed.

No software installation. Reap the benefits of a electronic solution to generate, edit and sign documents in PDF or Word format online. Transform them into templates for multiple use, add fillable fields to gather recipients?

Individuals file this form to: Request a tax return transcript for the current and the prior three years that includes most lines of the original tax return. Prior to submitting an application for an SBA loan, lenders must obtain income tax return transcripts from the IRS. The lender must verify the transcripts to information provided by the borrower and used by the lender to evaluate repayment of the loan.

The form is good for 1days. Saving you the time and expense of having to resubmit. Simplify Income Analysis: All tax transcripts include a summary coversheet that highlights and calculates key income verification line items, which can be customized based on.

This site is like a library, you could find million book here by using search box in the header.

Hiç yorum yok:

Yorum Gönder

Not: Yalnızca bu blogun üyesi yorum gönderebilir.